Investment Portfolio Optimization: Maximizing Returns While Minimizing Risk

Introduction to Investment Portfolio Optimization

In the world of finance, investment portfolio optimization is a vital idea that goals to realize the optimum steadiness between danger and return. It includes strategically allocating property inside a portfolio to maximise returns whereas minimizing the related dangers.

Understanding Risk and Return

Before delving into portfolio optimization techniques, it is important to understand the elemental ideas of danger and return in investing. Risk refers back to the uncertainty related to the potential for loss, whereas return represents the acquire or loss on an funding over a selected interval.

Modern Portfolio Theory (MPT)

Modern Portfolio Theory (MPT), launched by Harry Markowitz in 1952, types the muse of portfolio optimization. It means that buyers can assemble an optimum portfolio by diversifying property to attenuate danger for a given stage of return.

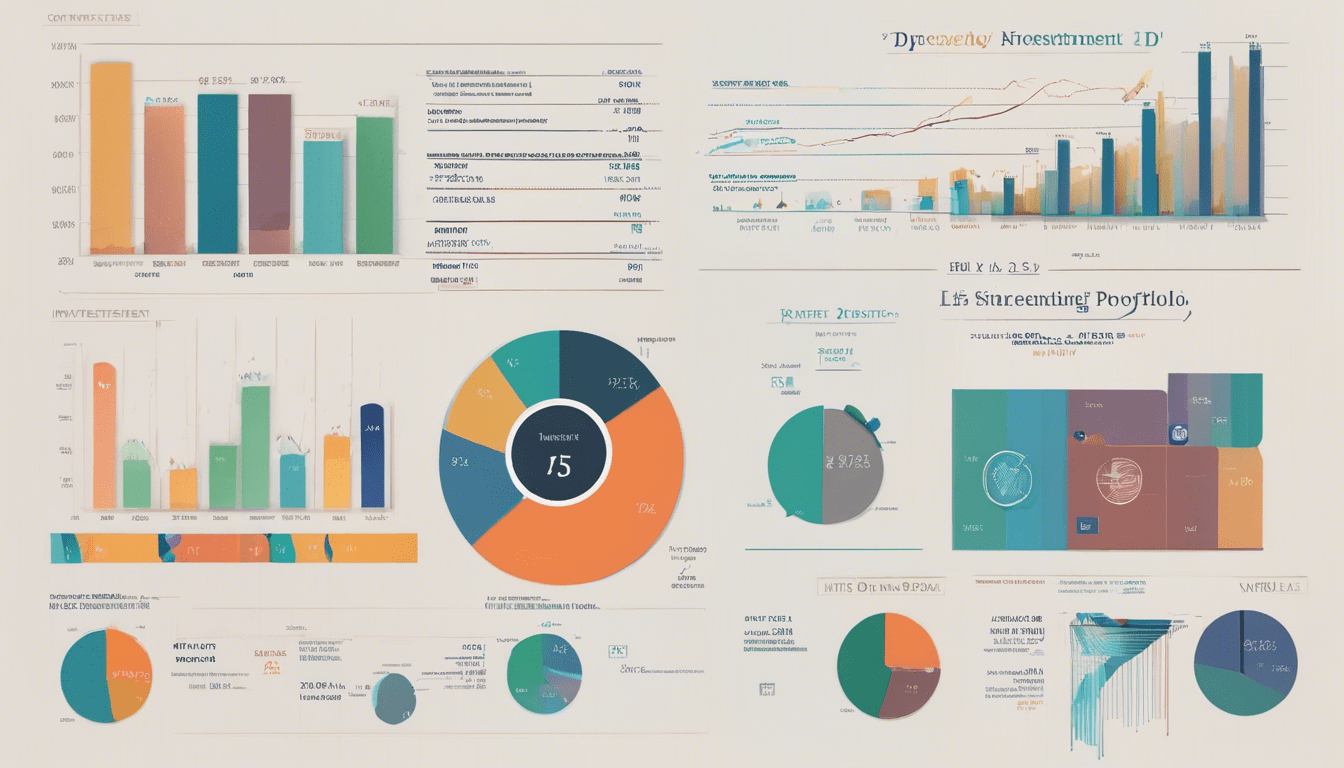

Asset Allocation Strategies

Asset allocation is a key element of portfolio optimization, involving the distribution of investments throughout varied asset courses reminiscent of shares, bonds, actual property, and commodities. Diversification, strategic asset allocation, and tactical asset allocation are widespread methods employed to realize optimum asset allocation.

Portfolio Rebalancing Techniques

Portfolio rebalancing is crucial to keep up the specified asset allocation over time. Techniques reminiscent of periodic rebalancing and threshold rebalancing assist buyers realign their portfolios to the goal allocation.

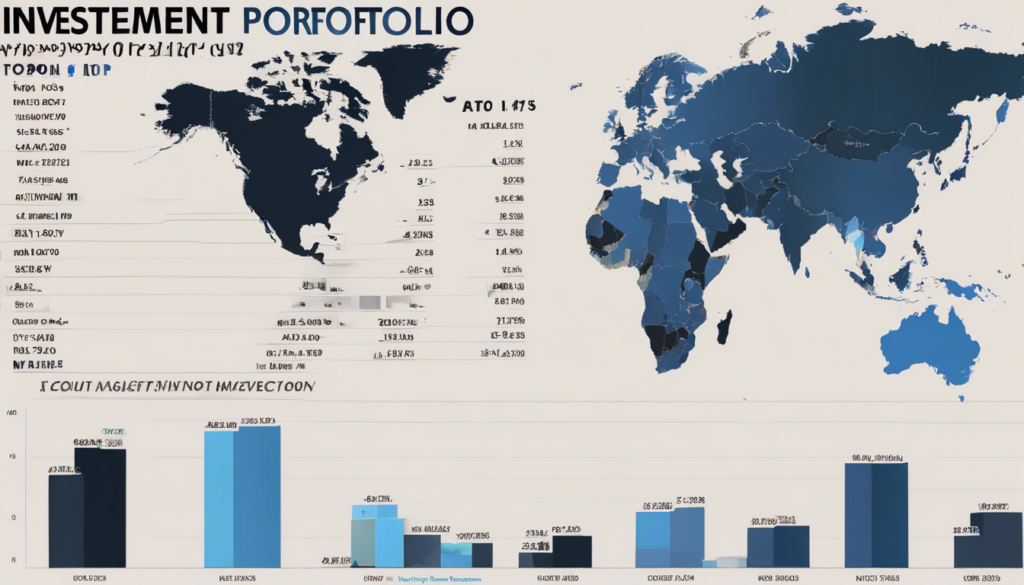

Importance of Asset Class Selection

Selecting the correct mix of asset courses is crucial for portfolio optimization. Factors reminiscent of funding objectives, danger tolerance, and time horizon affect asset class choice.

Tools and Methods for Portfolio Optimization

Several instruments and strategies support in portfolio optimization, together with mean-variance optimization, Monte Carlo simulation, and the Black-Litterman mannequin. These strategies assist buyers make knowledgeable selections about asset allocation and portfolio development.

Considerations for Individual Investors

Individual investors should contemplate their danger tolerance, time horizon, and tax implications when optimizing their portfolios. Understanding these elements ensures that the portfolio aligns with their monetary objectives and targets.

Robo-Advisors and Portfolio Optimization

Robo-advisors have gained reputation lately for his or her position in automating portfolio administration and optimization. While they provide advantages reminiscent of low charges and comfort, buyers ought to pay attention to their limitations and the significance of human oversight.

Challenges and Limitations of Portfolio Optimization

Despite its advantages, portfolio optimization faces challenges reminiscent of market uncertainties, information assumptions, and the chance of overfitting. It’s important for buyers to acknowledge these limitations and undertake a prudent strategy to portfolio administration.

The Role of Behavioral Finance

Behavioral finance performs a big position in portfolio optimization, as investor biases and feelings can impression decision-making. Recognizing these behavioral elements permits buyers to make extra rational and disciplined funding selections.

Monitoring and Adjusting Portfolios

Regular monitoring and changes are needed to make sure that the portfolio stays aligned with the investor’s targets and market circumstances. This includes periodic opinions and making needed changes based mostly on adjustments within the economic environment.

Case Studies in Portfolio Optimization

Examining real-life case research supplies invaluable insights into profitable portfolio optimization methods. By analyzing previous examples, buyers can study from each successes and failures and apply these classes to their very own funding strategy.

Conclusion

In conclusion, funding portfolio optimization is a dynamic course of that requires cautious consideration of varied elements, together with danger, return, asset allocation, and investor conduct. By using efficient optimization strategies and staying vigilant in monitoring their portfolios, buyers can maximize returns whereas minimizing danger over the long run.

FAQs

- What is the principle purpose of funding portfolio optimization? The main goal of portfolio optimization is to realize the optimum steadiness between danger and return by strategically allocating property inside a portfolio.

- How usually ought to I rebalance my funding portfolio? The frequency of portfolio rebalancing relies on particular person preferences and market circumstances. However, a typical apply is to rebalance yearly or at any time when the portfolio deviates considerably from the goal allocation.

- Can particular person buyers successfully optimize their portfolios with out skilled assist? Yes, particular person buyers can optimize their portfolios with correct analysis, understanding of their monetary objectives, and using out there instruments and sources. However, in search of skilled recommendation could also be helpful for advanced portfolios or buyers with restricted data and expertise.

- What are the important thing elements to contemplate when choosing asset courses for portfolio optimization? Key elements embrace funding objectives, danger tolerance, time horizon, and correlation between asset courses. Understanding these elements helps buyers create a diversified portfolio that aligns with their targets.

- Are there any dangers related to utilizing robo-advisors for portfolio optimization? While robo-advisors provide comfort and low charges, they might lack the customized strategy and human oversight supplied by conventional monetary advisors. Additionally, there is a danger of technical glitches or errors in algorithm-based funding methods.